If you have already created an account and it’s before 3pm, your trade should go through that day. Step 8 – Your account is now setup and you get a last chance to confirm the purchase.

The rest of the data you should have memorized 😉 Step 7 – This is the hardest part… go find your child’s social security #, or better yet, go ask your wife. Step 6 – First you create an account for yourself, then you create the custodial account for your minor. Step 5 – Here is a summary of how the account creation process works. Step 4 – Confirm you want to redeem your Stockpile gift card for your selected stock or ETF. – DIS just raised their dividend a little over 4%. Step 3 – After clicking on a ticker symbol, you see charts, data and news for the company. (The process is targeted towards kids and has many options and logos for the same company) Step 2 – Pick which stock or ETF you would like to invest in.

#STOCKPILE GIFT CODE#

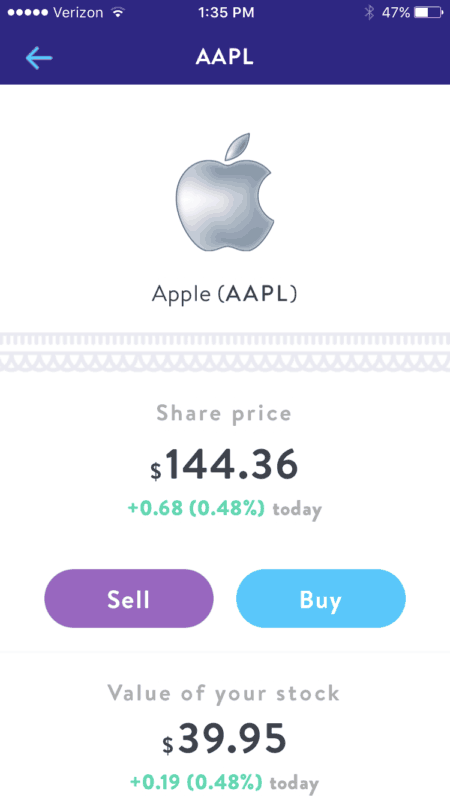

Step 1 – Enter Gift Card – (this code in the picture isn’t going to work). Be prepared to enter the SSN for both you and your child.Ĭreating a Stockpile account with a gift card looks like this. The longest part of the account creation was scouring the house for a social security number. The setup is simple and really only took a few minutes. Here is the process to create a custodial account with Stockpile.

#STOCKPILE GIFT HOW TO#

How to Setup a Stockpile Custodial Account (10 Steps) Stockpile accounts come with the option of reinvesting all dividends earned, which presents a great passive income opportunity for anyone who wants to venture further into the world of stock investing. As the name implies, a DRIP automatically puts your dividend payouts right back into your portfolio, thereby exponentially increasing your potential for higher returns on your investments than if you had pocketed the dividends instead. Of course, it’s not enough to simply invest in dividend stocks – you should be maximizing your gains with a dividend reinvestment plan (DRIP).

#STOCKPILE GIFT FULL#

How much money are you currently investing in dividend stocks ? If you’ve been focused on other investment options because prices for full shares of dividend stocks are too expensive, then Stockpile is an excellent resource for accessing fractional shares of stocks that pay dividends.

#STOCKPILE GIFT PROFESSIONAL#

If your looking for a professional brokerage for an active investor, I recommend IB – here is my Interactive Brokers review. However, this is not the trading platform for an active investor. Compared to E*Trade’s $6.95/trade, Charles Schwab’s $4.95/trade and AmeriTrade’s $6.95/trade fees, Stockpile is one of the most affordable online stock trading platforms out there. There are no monthly account fees or account balance minimums – just a $0.99 fee each time you buy/sell stocks (plus a 3% surcharge, if you pay with a credit card).

With Stockpile, go ahead and invest whatever amount you can afford into a particular stock or ETF (there are more than 1,000 to choose from), whether that’s $10 or $800+ (one-time deposit or monthly Stockpile lets you set up recurring deposits, if you’d like). This means that popular-but-expensive stocks like Apple, Amazon, Google and Netflix are no longer out of reach for casual investors who simply can’t afford to drop hundreds or thousands of dollars on a single share. One of the best benefits Stockpile offers is the ability to buy partial shares of stock. Want to give your family and friends the gift of financial prosperity for the holidays? Here are some reasons why Stockpile is an unusual, though awesome gift idea for any celebration: Buy Partial Shares of Stock Better yet, Stockpile has a gift card option, which is truly a gift that keeps on giving over time (even if it’s not as exciting as a new video game or spa treatment). Stockpile, an online broker that gives everyday investors access to fractional shares of stocks and ETFs, is a great place to start investing in stocks. Thanks to the rise of low-fee investment platforms like Stockpile, achieving financial independence is no longer a far-fetched fantasy – middle class and even low-income folks can also get more involved in wealth accumulation without requiring the help of a human financial adviser. The financial technology (“fintech”) sector is booming right now, as more and more people want to get involved in more complicated aspects of investing that used to be reserved for wealthier individuals and finance professionals. In my Stockpile review, I share the process of creating a custodial account (with pictures) and how quickly one can setup an account after receiving a Stockpile gift card. Want to give the gift of stocks to a friend or loved one? This is how I chose to introduce my child to the wonderful world of investing.

0 kommentar(er)

0 kommentar(er)